how do i get my employer to withhold more tax

If you have no employer to withhold federal taxes then youre responsible for withholding your own. 1 They may make quarterly estimated tax payments totaling 100 of their previous years tax liability.

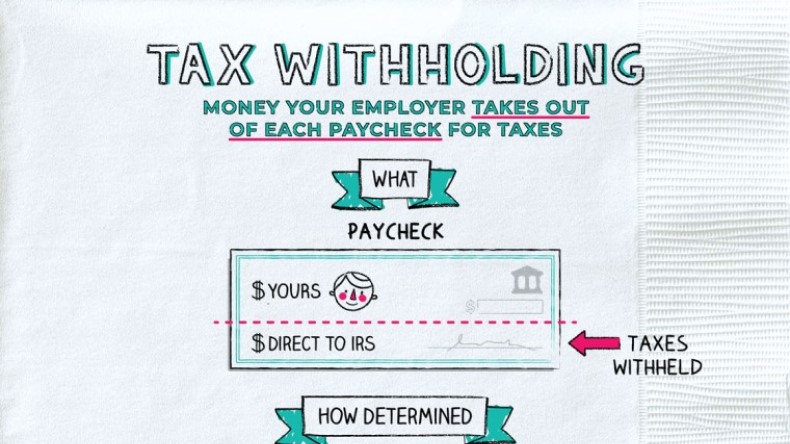

What Is Tax Withholding All Your Questions Answered By Napkin Finance

So what Im primarily concerned about is my new employer isnt withholding ANY federal taxes with the exception of medicare.

. It will help you as you transition to the new Form W-4 for 2020 and later. Form W-4 Employees Withholding Certificate. Complete a new Form W-4P Withholding Certificate for Pension or Annuity Payments and submit it to your payer.

Income Tax Withholding Assistant for Employers. Determine if estimated tax payments are necessary. The W-4 is a form that you complete and give to your employer not the IRS for federal tax and the equivalent form for state tax withholding.

In order to adjust your tax withholding you will have to complete a new W-4 form with your employer. Then compare that number to the number of allowances you get when you complete the new Form W-4. The amount of income tax your employer withholds from your regular pay depends on two things.

You can use the Tax Withholding Estimator to estimate your 2020 income tax. Register for employer withholding tax online through the Online PA-100. To adjust your withholding youll need to fill out a new W-4 tax form.

They can use their results from the estimator to help fill out the form and adjust their income tax withholding. If too little is being taken increase the withheld amount. Employers generally must withhold federal income tax from employees wages.

The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer a new Form W-4. Make your payments on time. Use the slider to pick how much of a tax refund youd like and follow the steps after to adjust your tax withholding.

All youll need is. My husband is retired. If too much tax is being taken from your paycheck decrease the withholding on your W-4.

Submit the form to your employer. To figure out how much tax to withhold use the employees Form W-4 the appropriate method and the appropriate withholding table described in Publication 15-T Federal Income Tax Withholding Methods. Other sources of income.

Use the Tax Withholding Estimator on IRSgov. The withholding of salary occurs when an employer fails to pay an employee the wages or salary they have promised to pay for the work done by the employee. If its been a few years since you filled out a Form W-4 for your job you might think you need to calculate the number of allowances you need to claim to get the right withholding.

Figure out what your employer owes you 4. Calculate the minimum estimated tax payment to make. In 2021 I worked Jan - Nov for a university in New Hampshire who DID withhold federal taxes.

Its also probably a good idea to visit the IRS withholding calculator. For help with your withholding you may use the Tax Withholding Estimator. A good first stop.

You must deposit your withholdings. Adjust your tax withholding to get more money per paycheck. Next add in how much federal income tax has already been withheld year to date.

Your payee must get our approval to reduce the amount you would normally withhold by completing a PAYG Withholding variation application. Employers are generally required to withhold Ohio income tax on an employees compensation if it is earned for personal services performed in this state. You can increase your withholding to avoid.

You need to submit a new W-4 to your employer giving the new amounts to be withheld. I began working for a local high school Dec 2021. To adjust your withholding you will need to complete a Form W-4 and give it to your employer.

Dont file with the irs. Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. Take your new withholding amount per pay period and multiply it by the number of pay periods remaining in the year.

574720 B 1 and 574706. You can ask your employer for a copy of this form or you can obtain it directly from the IRS. This total represents approximately how much total federal tax will be withheld from your paycheck for the year.

Fill out a new W-4 or W-4P form. Here are the steps to calculate withholding tax. First gather all the documentation you need to reference to calculate withholding tax.

Credit card payments may be made through the Ohio Business Gateway OBG or over the Internet by visiting the ACI Payments Inc. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees wages. Register for employer withholding tax online through the Online PA-100.

But allowances arent part of Form W-4 anymore. If the employee has breached their employment contract the employer is legally allowed to withhold payment. Make an additional or estimated tax payment to the IRS before the end of the year.

Thus even if an employee lives in another state if they work in Ohio either part-time or full-time the employer must withhold Ohio income tax. Employers can file and pay employer withholding tax returns and submit W-2 information online using e-TIDES by phone using TeleFile or through third-party software. For more detailed employer withholding tax information please review the Employer Withholding Information Guide.

Im concerned only about 2022. The withholding tax amount depends on a number of factors so youll need the employees W-4 to help with your calculations as well as the withholding tax tables and the IRS. Follow the instructions under How to Adjust Your Withholding to fill out the W-4 or W-4P to change your tax withholding and achieve your refund goal.

This usually happens only in special circumstances where your employee can show that the withholding rate will result in them having more tax withheld than is required to cover the total tax they will need to pay in the year. Use the Income Tax Withholding Assistant if you typically use Publication. You can use your American Express DiscoverNOVUS MasterCard or Visa credit card to pay your withholding tax liability.

The information you give your employer on Form W4. 2 They may make quarterly estimated tax payments totaling 90 of the current years. The amount you earn.

Be sure to ask your employer the number of allowances you are currently making. To adjust your withholding is a pretty simple process. The W-4 communicates to your employer s how much federal andor state tax you - and your spouse if she works - wish to have withheld from each paycheck in a pay period.

There is a service fee charged by ACI Payments Inc. But before you do that experts recommend doing a little legwork to determine which tweaks are necessary.

9 Common Us Tax Forms And Their Purpose Infographic Income Tax Preparation Tax Forms Us Tax

The Treasury Department Just Released Updated Tax Withholding Tables That Will Change Your Paycheck Mother Jones Paycheck You Changed Release

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

This Monthly Tax Reference Guide Is For Any Business That Has Employees And Contracto Bookkeeping Business Small Business Accounting Small Business Bookkeeping

Fillable Form W 4 Or Employee S Withholding Certificate Edit Sign Download In Pdf Pdfrun Online Taxes Federal Income Tax Tax Forms

What Is Form W 4 Tax Forms Signs Youre In Love The Motley Fool

Form W 4 Employee S Withholding Certificate 2018 Mbcvirtual In 2022 Changing Jobs Federal Income Tax Second Job

Form W 4 Employee S Withholding Certificate 2016 Mbcvirtual In 2022

Irs Improves Online Tax Withholding Calculator Cpa Practice Advisor

What Is Tax Withholding All Your Questions Answered By Napkin Finance

What Are Payroll Taxes Employers Need To Withhold Payroll Taxes From Employee Wages And Self Employed People Need To Payroll Taxes Payroll Small Business Tax

Best Ways To Get The Most Money When You Fill Out Your W 4 Form Tax Forms Tax How To Get Money

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contracto Bookkeeping Business Small Business Accounting Small Business Bookkeeping

How Does An Employer Withhold Tax From An Employee Taxry

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm